NOTES TO FINANCIAL STATEMENTS

30 June 2015

Karin Technology Holdings Limited

Annual Report 2015

96

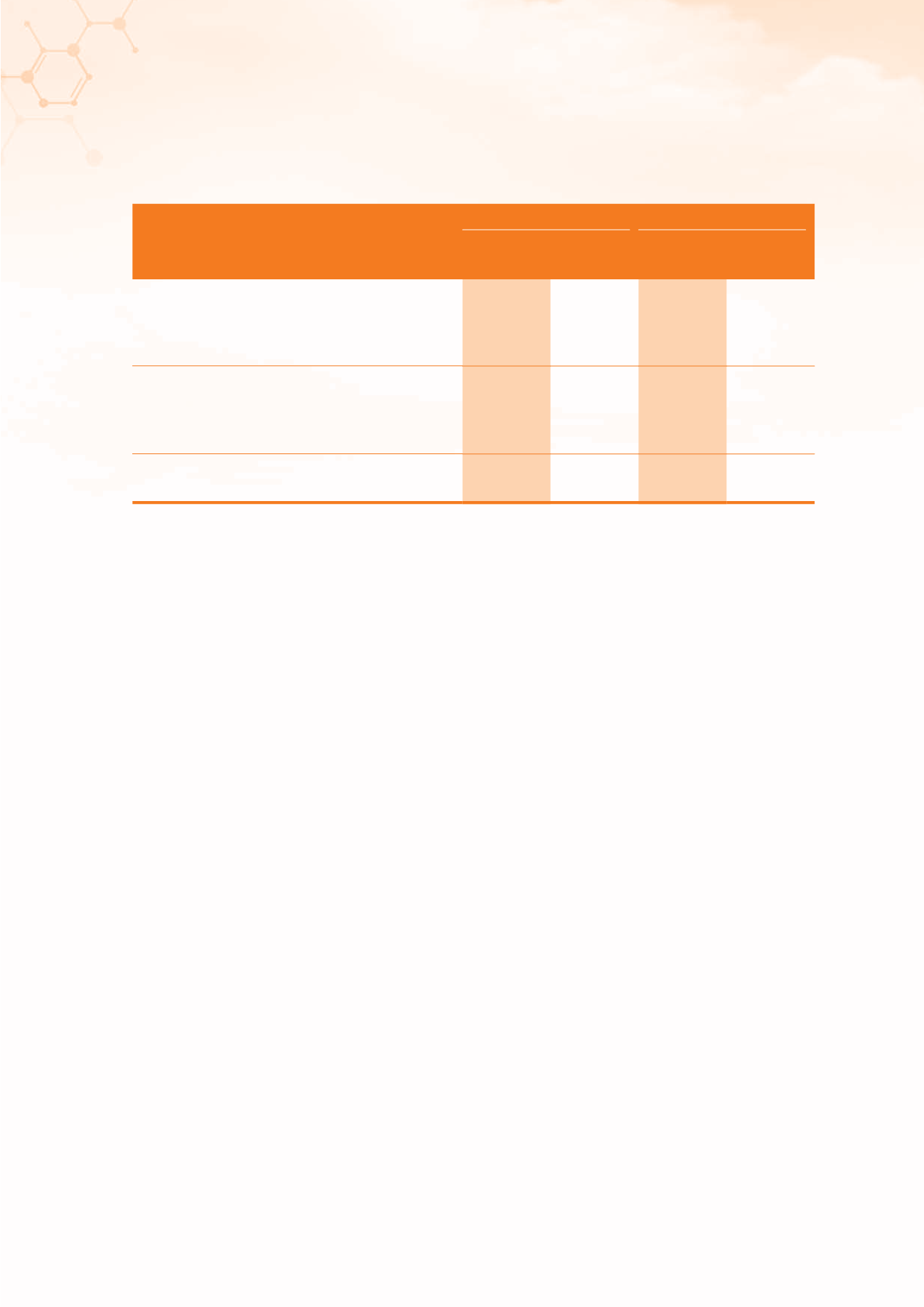

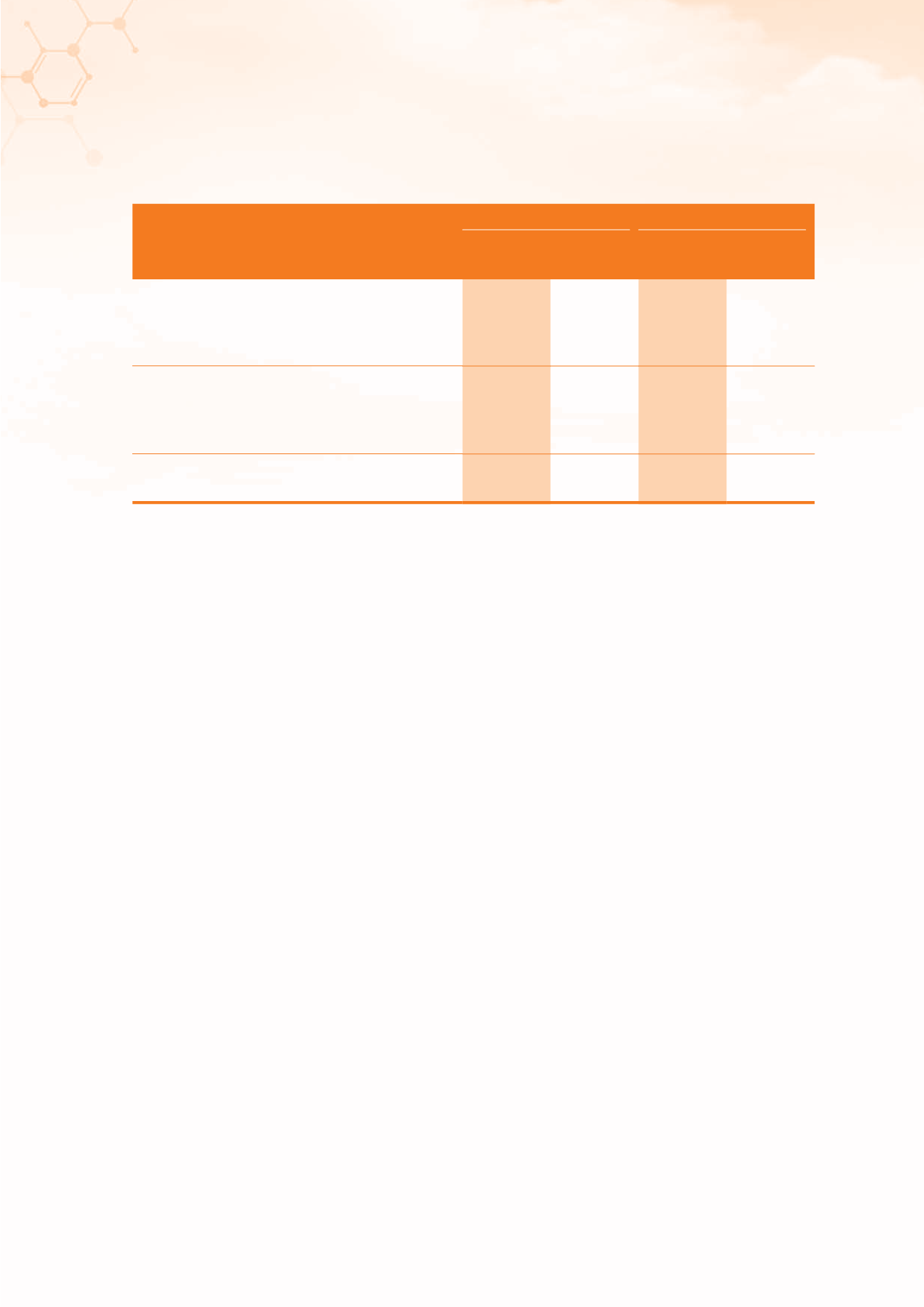

19. PREPAYMENTS, DEPOSITS AND OTHER RECEIVABLES

Group

Company

2015

2015

HK$’000

HK$’000

HK$’000

HK$’000

Prepayments

45,113

–

–

Deposits

3,030

–

–

Other receivables

5,911

6,216

–

_______

_______

_______

_____

54,054

–

Current portion included in prepayments,

deposits and other receivables

(53,456)

–

_______

_______

_______

_____

Non-current portion

598

6,730

–

–

None of the above assets is either past due or impaired. The financial assets included in the above balances,

including deposits and other receivables, relate to receivables for which there was no recent history of default.

5IF (SPVQ T QSFQBZNFOUT BT BU

+VOF

JODMVEFE B QBZNFOU UP B UIJSE QBSUZ GPS UIF QVSDIBTF PG B QSPQFSUZ

MPDBUFE JO #FJKJOH BNPVOUJOH UP ),

5IF USBOTBDUJPO XBT DPNQMFUFE JO +VMZ

20. FORWARD CURRENCY CONTRACTS

The Group has entered into various forward currency contracts to manage its exchange rate exposures which

did not meet the criteria for hedge accounting under IFRSs. The forward currency contracts are derivatives and

are classified as financial assets at fair value through profit or loss and are stated at fair values at the end of the

reporting period. The fair values were determined by BMI Appraisals Limited, independent professionally qualified

valuers, and disclosed in these financial statements based on valuation techniques for which all inputs which

have a significant effect on the recorded fair value are observable, either directly or indirectly (Level 2 of the fair

value hierarchy as defined in IFRS 7).

'BJS WBMVF MPTTFT PG OPO IFEHJOH DVSSFODZ EFSJWBUJWFT BNPVOUJOH UP ),

),

XFSF

debited to profit or loss as “other expenses, net” during the year.

The fair value of the Group’s forward currency contracts is determined by discounting the estimated future cash

flows which are based on the terms and conditions of the forward currency contracts, the historical prices of

the underlying currencies, the contractual period, discount rate and other factors materially affecting the values

of the forward contracts.

During the year, there were no transfers of fair value measurements between Level 1 and Level 2 and no transfers

into or out of Level 3 for the financial instruments.