Karin Technology Holdings Limited

Annual Report 2015

6

Financial

Review

STATEMENT OF FINANCIAL POSITION

NON-CURRENT ASSETS

Non-current assets comprised goodwill of HK$2.1 million;

investment properties, office equipment, leasehold land

and buildings and motor vehicles amounting to HK$426.1

million; deferred tax assets of HK$1.0 million; investment

in an associate of HK$0.8 million; prepayment for office

renovation of HK$0.6 million and a factored trade receivable

of HK$0.5 million. At 30 June 2015, non-current assets

amounted to HK$431.1 million, representing approximately

34.5% of the total assets. Increase in non-current assets

from last year was mainly due to (1) the acquisition of

an office premise in Beijing of HK$13.5 million; and (2)

increase in office equipment, leasehold land and buildings

of HK$11.6 million due to renovation of Hong Kong office.

CURRENT ASSETS

As at 30 June 2015, current assets amounted to HK$816.9

million, an increase of HK$160.7 million compared to

the immediately preceding financial year end at 30 June

2014. The increase was mostly because of (1) increase in

inventories of HK$54.1 million as a result of increasing

sales; (2) increase in cash and cash equivalents by HK$48.2

million which was mainly due to higher cash flow generated

from increase in businesses of CD and CEP segments; and

(3) increase in trade and bills receivables of HK$51.6 million.

CURRENT LIABILITIES

As at 30 June 2015, current liabilities amounted to

approximately HK$522.8 million, an increase of HK$105.7

million compared to the immediately preceding financial

year end at 30 June 2014. The increase was mainly due

to (1) increase in trade payables of HK$82.2 million which

was in line with increase in cost of sales; (2) increase in

other payables and accruals of HK$42.4 million which

was mostly due to (A) payment in advance of HK$33.5

million from customers for certain projects; and (B) increase

in staff bonus provision of HK$7.8 million due to profit

improvement; (3) increase in income tax payable of HK$6.8

million due to increase in profit for the current year; and

offset by decrease in interest-bearing bank and other

borrowings of HK$25.7 million.

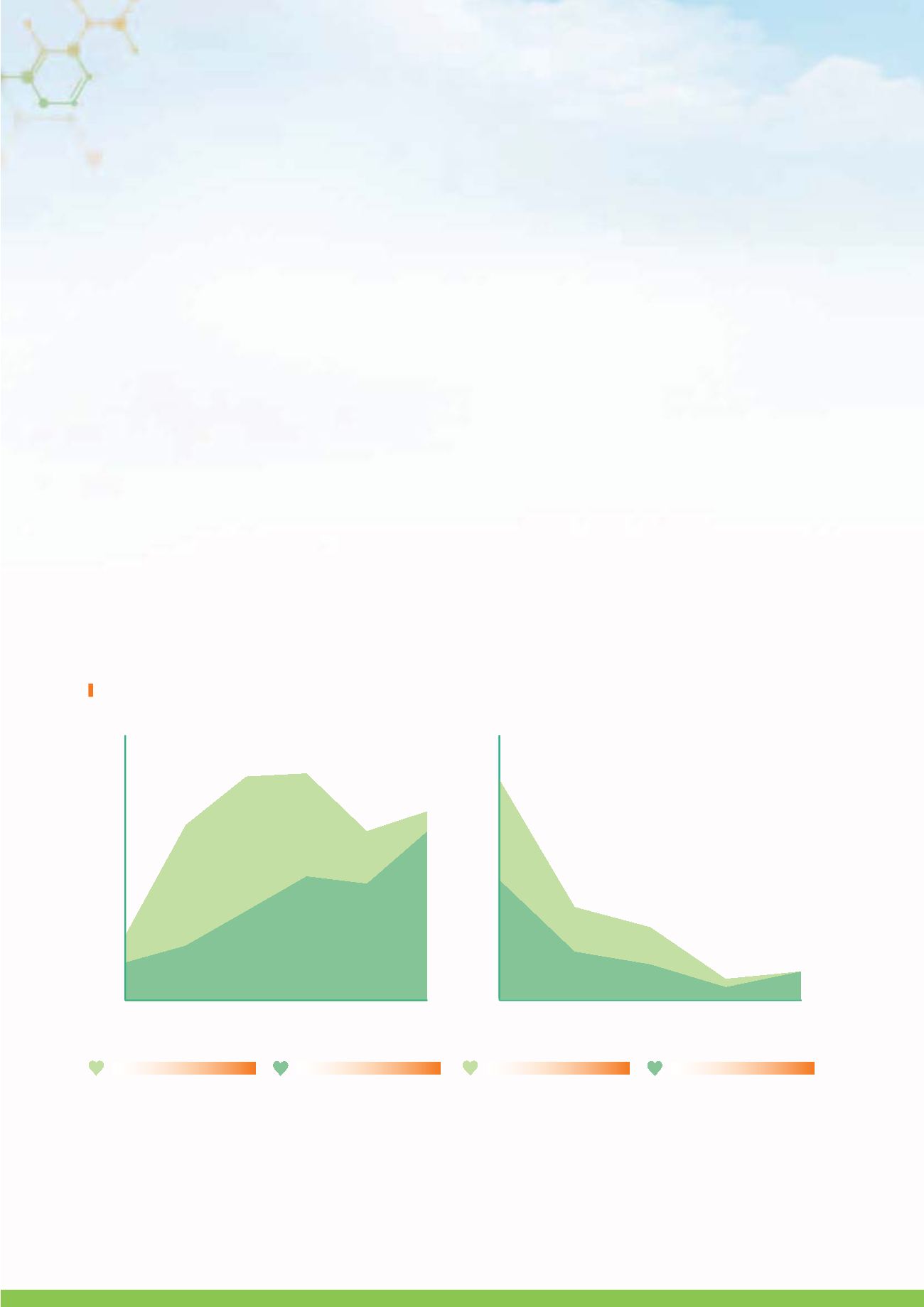

S

TAFF

S

TATISTICS

0

5%

10%

15%

20%

25%

45

or

above

40-44

35-39

30-34

25-29

24

or

below

AGE RANGE

PRC AND OTHERS

HK

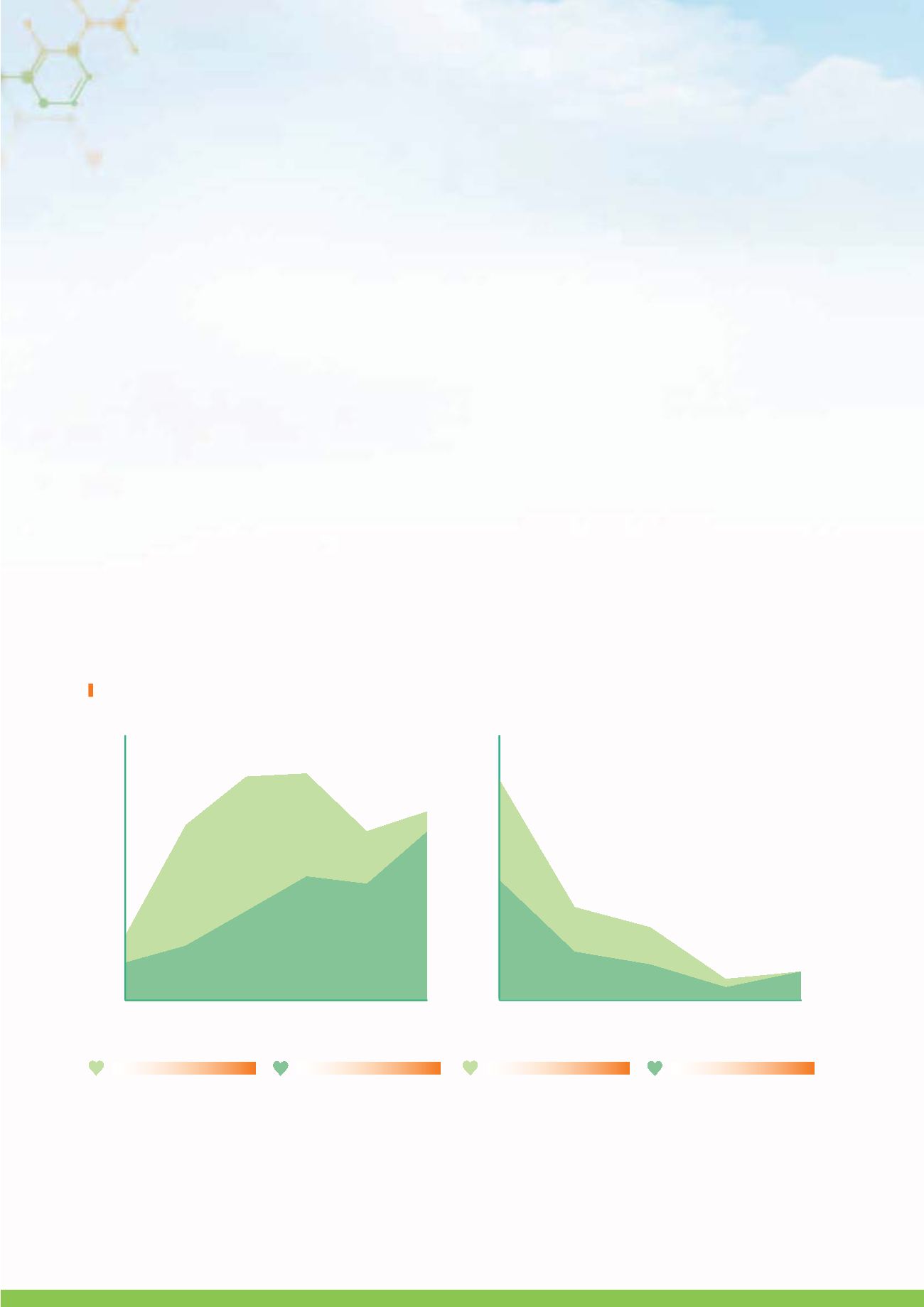

YEARS OF SERVICE

PRC AND OTHERS

HK

0

10%

20%

30%

40%

50%

60%

21

or

above

16-20

11-15

6-10

5

or

below